The economic impact of the COVID-19 pandemic will be felt long after masks are cast aside, and life is led less than six feet apart. However, recent feasibility studies conducted by Convergent Nonprofit Solutions suggest that many local economies are faring reasonably well, and fundraising efforts are still viable. In fact, the outlook is positive for nonprofit fundraising in 2021.

Convergent counsels nonprofit organizations of every stripe to conduct a feasibility study before a fundraising campaign. The study helps determine if the organization is positioned to meet a test fundraising dollar goal and whether the plan requiring funding has merit. Also, the organization’s constituency and community leaders can suggest volunteer leadership to conduct the fundraising campaign.

COVID-19 tossed in a factor of uncertainty for meeting a fundraising goal. Would the pandemic diminish the likelihood of sufficient financial support? What should be expected regarding the time it will take to return to pre-COVID economic conditions or something close to it?

Convergent has conducted feasibility studies for nine organizations dating from the pandemic’s arrival in America to the end of 2020. The clients include organizations representing healthcare, local/regional economic development groups, education, and the arts. Service delivery boundaries characterized by these nonprofits are statewide, regional, or county. Almost 60 percent of those surveyed characterized their local economy as being in good to excellent shape for recovery from the COVID-19 pandemic. Only five percent of those surveyed felt their local economy was in a poor or unstable position for recovery.

We asked four questions directly related to the pandemic’s impact. How are your industry and your business faring? Did you furlough or lay off employees? How long do you think it would take the economy to recover once the pandemic subsides? What we discovered follows:

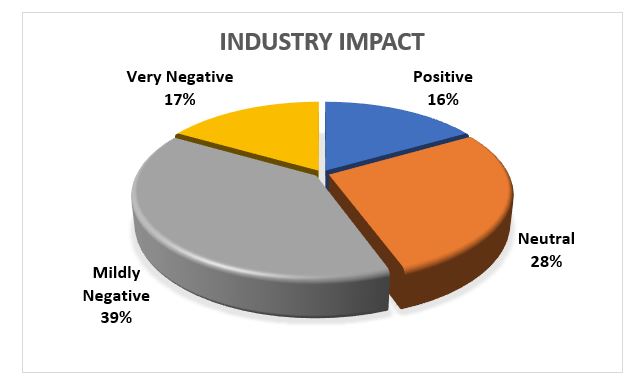

How has COVID-19 and the associated disruption impacted your industry?

Industries deemed essential such as manufacturing, healthcare, agriculture, and residential real estate, said their respective sectors are mostly neutral to mildly negative affected. Neutral essentially means business did not drop off. Mildly negative refers to the retooling and expense in manufacturing plants and healthcare to meet pandemic safety measures and, in some instances, disruptions in supply and distribution chains.

Some industries experienced more demand for their product or service. Some retooled to accommodate the manufacture of pandemic related safety items. These PPE items include masks, shields, barriers, and the like.

Small retailers and restaurants bore the brunt of very negative consequences with the shuttering of businesses or steep declines in revenue.

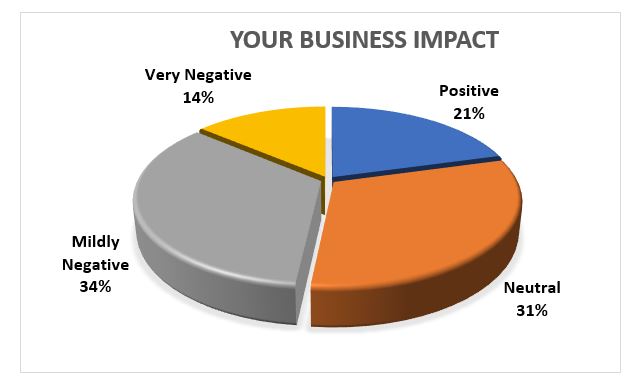

How has COVID-19 and the associated disruption impacted your business?

For all measures, the interviewees said their business is faring three to five percentage points better or less negatively than their view of their industry as a whole.

Here is a sampling of what we heard from verbatims expressed by our interviewees.

- An uptick in residential and industrial service still has not made up for the commercial’s downturn, but we are meeting our revenue targets.

- It was going well before the pandemic. However, now we are seeing companies push back projects and slash their capital budgets. There is too much uncertainty until a vaccine, and the best therapeutics are more widely available.

- We suffered at the start when manufacturing shut down, but now we are back to where we started.

- In my industry, your approach to sales makes a big difference in whether or not you’ve been able to weather the storm. We thought it would be a low volume year, but it’s not.

- Lots of industries are hiring. Things are pretty good even with COVID-19.

- We are an essential industry. During Q2, we were slow due to customers slowing down or closed. We worked on lean projects and used the time to improve processes. We were off about 30% for Q2 and have come back strong and look to be up for the year.

- We implemented much change quickly. We do temperature checks, wear masks, social distance, and have modified schedules. Year over year, we will be even.

- Since agriculture workers were deemed essential, there has been little fall off for our business.

- The realty business has us busier than we’ve ever been.

- As a healthcare professional, I can assure you that our patient load has not decreased

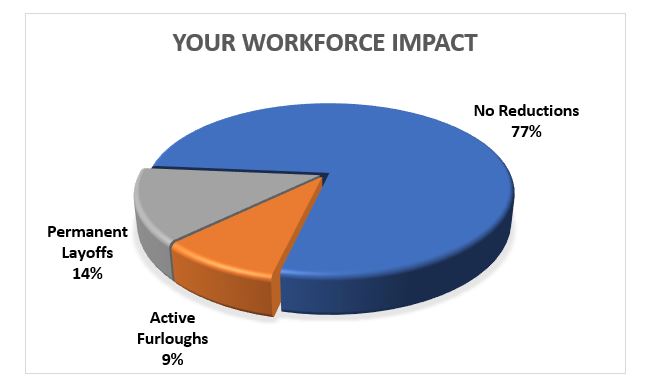

How has COVID-19 impacted your workforce?

The study participants indicate that 86% of employees would have either never left employment or have returned after furloughs ended. This figure does not account for businesses that may have added employees during the pandemic.

As cited in one of the interviewee comments below, some businesses discovered they could operate more efficiently with fewer employees, and their layoffs are permanent.

- We were in the position to keep people, but it did impact our bottom line.

- We took a hit in March and April but have been able to keep our core workforce intact since then.

- Our people are the most important asset we have, and we want them to be with us when this is over.

- We took some serious steps early in the pandemic and learned we could be successful a little leaner. All employees took pay cuts, which have been restored. We furloughed 11, and about half came back.

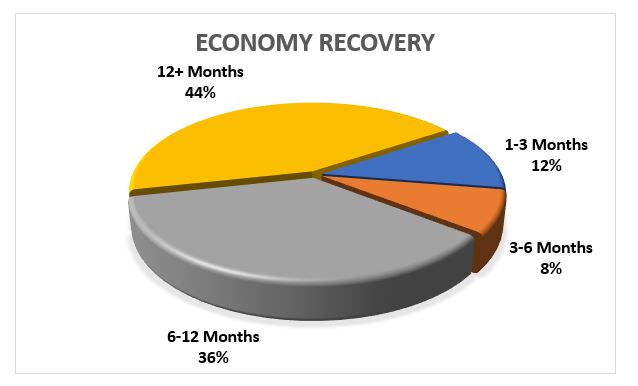

What is the timeframe you’re planning on in terms of economic recovery?

An early December 2020 article in the Chicago Tribune cited 48 economists surveyed by the National Association for Business Economics. (NABE) “It found that 73% of surveyed forecasters say the economy will return to its pre-pandemic level by late 2021. That reflects greater optimism than the forecasters had expressed a couple of months ago when just 38% of them said they thought a full recovery could occur before 2022.”

The Tribune article further stated, “if the NABE’s forecasts are right, a full recovery could be reached by late next year. If so, it would mark a remarkably quick rebound for the economy after its breathtaking plummet during the spring. When the coronavirus was first spreading, and governors around the country ordered businesses to shut down, the U.S. economy shrank by a punishing annualized rate of 31.4% from April through June.”

The article appears to reflect our respondents’ overriding sentiment. Eighty percent say the recovery would occur in six months or more. Since several of the studies were conducted early in the pandemic, it’s not surprising that this timeline would reflect a greater emphasis on a year or more for the economy to recover.

- It may be a “V” shaped recovery with a rapid recovery once the virus abates and confidence returns.

- I think it will be three months after mass vaccination.

- If a vaccine is rolled out in Q1 and Congress passes a stimulus plan, we’ll see a recovery begin Q3 2021.

- Small business timeline, 12+ months. There will be different return rates based upon the sector.

- After the national election, some things will improve when we see the light at the end of the tunnel, regardless of the election outcome.

The timeline for a successful capital campaign typically approaches the 10-12 month mark. We counsel our nonprofit clients to consider a campaign now. A well-run feasibility study will take eight to 10 weeks to help shore up the fundable plan, inform investors and potential investors, and ensure the organization has Asking Rights™.

Many nonprofits need funding now more than ever if they are going to reach their goals for this year and sustain their organization’s mission for the future. As our studies indicate, nonprofit leaders should not let fears of the pandemic economy impact their decisions to move forward on a capital campaign for long-term funding.