A data-driven approach to major gift fundraising and capital campaigns can help you set the bar high, but at an appropriate level, and assure that your funding effort will have the best possible chance for success. I’ll share two examples I’ve recently encountered:

Organization A received an abnormally large investment from a first-time donor via a direct mail campaign, not in “major gifts” strata, but much larger than the typical direct mail response. Knowing that data point wasn’t typical, the CEO and Development Director scheduled a meeting to get to know this new donor. Fast forward several years and the family had made multiple transformative major gifts to the organization.

Organization B had set its sights on engaging a recently relocated new executive at a large multinational company headquartered nearby. There was direct knowledge of an affinity for the organization but no relational connection to the prospect. A wealth screening unearthed that the executive’s spouse had been quietly making modest donations for some time under her name, which wasn’t known by the organization.

As you see in these small anecdotes, knowing the right data points to pay attention to and signals to watch for can be transformative for your resource development strategies and future success. Let’s dig into other ways you can turn data into dollars in your next fundraising campaign.

Before Your Campaign: Target and Balance

Whether you’re identifying new donors (or investors, as we call them) or evaluating your current investors, you should look first at giving trends within your existing database. Hopefully this has been an ongoing process for your nonprofit organization, feeding information into regular marketing and investor relations touchpoints for your current circle of supporters. If not, it’s not too late. Starting targeted outreach efforts at any time is better than having none, and tracking the right data points over time can provide invaluable context that can later be leveraged to help maximize the level of investment from each individual.

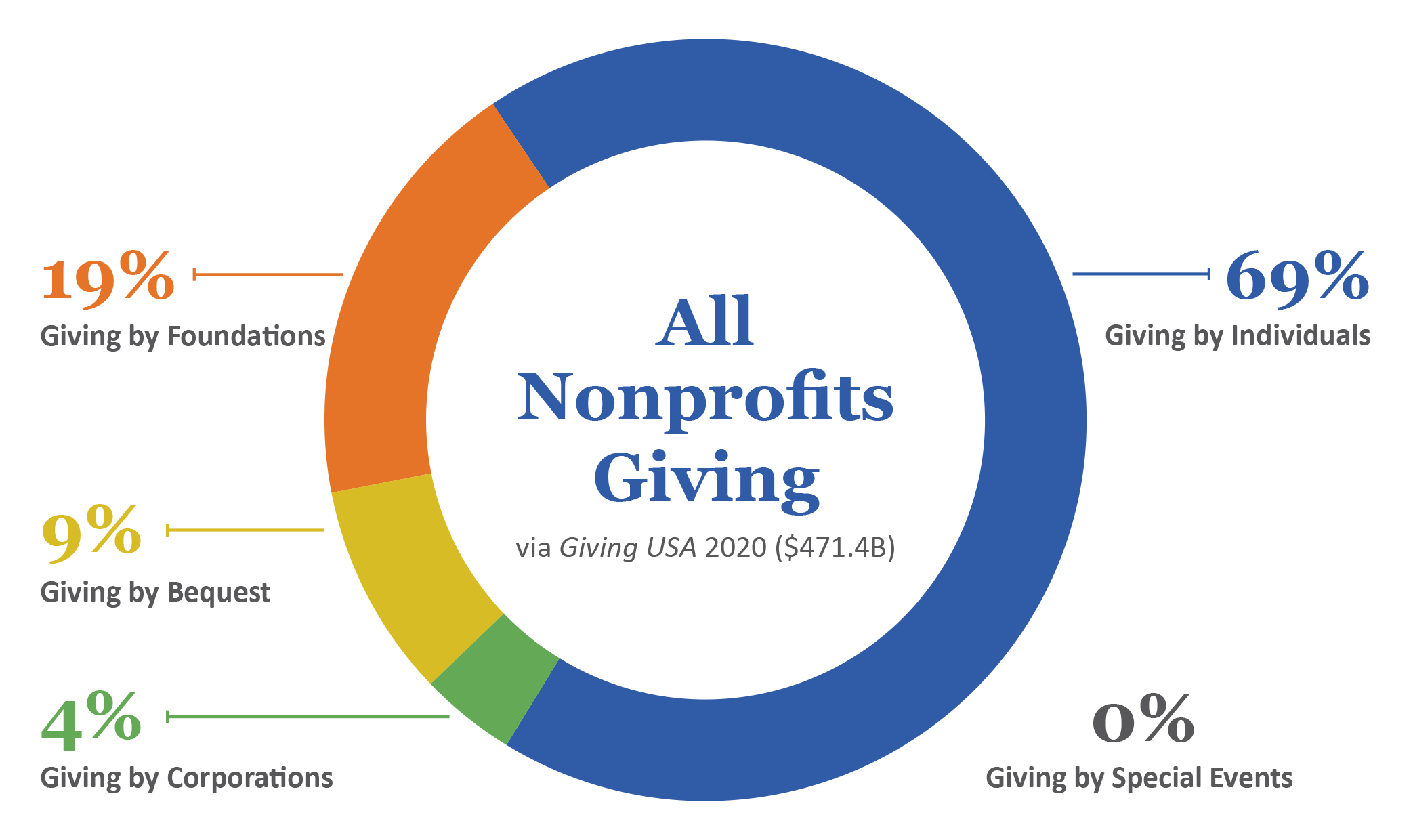

While many nonprofit leaders look to replicate the Giving USA model shown below, customizing your funding stream to what your community and your organization can support and cultivate is a wiser decision. We often help our clients balance their mix of public and private funding, major gift level investors and smaller givers, foundations, corporations, and individual investors so the organization doesn’t find itself overly dependent on one area or another for sustainability.

Your Donor Data: Take A Deeper Look

The next step is to drill down further on your major investors and prospective investors, analyzing giving capacity and propensity using wealth screening. Screening tools typically take some or all of your donor database using public records and statistical algorithms to calculate ratings and scores for each matched record – we call this wealth analytics. We screen our clients’ databases using multiple resources for wealth markers such as household income, business income, total assets, estimated annual donations, and property ownership accompanied by the individual’s propensity to give to charitable causes. Wealth analytics intelligence allows for an estimation of the individual’s capacity and informs the development of a cultivation strategy for each prospect.

As valuable as this intelligence is, what wealth analytics cannot find is equally important in developing the right strategies. Knowing and managing your board and staff’s expectations correctly when you present them with investor screening data is critical. Screening cannot provide information on current cash or bank balances, most salaries, stock holdings, and offshore or international assets. That’s why holistic conversations about capacity and propensity of prospective investors with your board and campaign leaders can provide insight that is very valuable when paired with the wealth screening data. Growing affinity and relational equity is always the critical variable in maximizing the potential results from wealth analytics.

As detailed by Philanthropy News Digest in an article titled, “The Importance of Donor Data and How to Use It Effectively”, maximizing the benefits of wealth screening can help you:

- Gauge likely major gift prospects.

- Identify important and potentially “leverageable” connections.

- Prioritize engagements to reach your fundraising goals.

Your Feasibility Study: Qualitative and Quantitative

With data analysis and benchmarking in place, the next step in laying the foundation for a capital campaign funding effort is to determine an accurate, actionable assessment of your proposed campaign’s feasibility through a feasibility study or, as we call it, an opportunity analysis.

In addition to verifying a level of support and feasible goal range, the study helps your funding constituency develop a sense of ownership over your proposed plan of work. Whether you’re raising money for new construction or renovations, programmatic expansions, or operating expenses, your feasibility study will provide a foundation for your upcoming capital campaign. It is 10-12 weeks well spent having an outside consultant gather valuable information.

In-person interviews in the study will be used to validate your goal, test (and help refine) your case for support, further vet lead gifts and investors, and help identify additional campaign leadership in the community. At the end of the feasibility studies we conduct, Convergent project directors provide qualitative information combined with quantitative data and often wealth analytics, so our clients have a very clear picture of how much can be raised in what timeframe… or what changes need to be made in order to raise the maximum amount of dollars for your organization in a capital campaign.

Not Quite Ready for a Feasibility Study or Campaign?

The important thing to remember about data and analytics is that they are only as valuable as their practical application. Having data about your investors doesn’t help if you don’t have the tactics in place to leverage it to maximize funding. The best time to implement data analytics into your development practices is actually before a feasibility study or capital campaign. Along with credibility and clear outcomes, a critical component of your organization’s Asking Rights™ is having sound fundraising practices. Convergent offers Resource Development services designed to help nonprofits assess and improve their fundraising skills to set the stage for maximized success in a capital campaign – whether it’s six or 24 months away. Let us know if you want to discuss your funding needs and goals today.