As we watch the national economy–and each of our own communities–grapple with the pandemic, nonprofits cannot lose sight of the element most crucial to their sustainability and even survival: Investable OutcomesTM. In our Emerge Ready: Fundraising During and After COVID-19 webinar, we shared the results of a survey of nonprofit leaders. Our research showed that more than 81 percent of nonprofit executives and Board members feel that pre-pandemic funding levels are now questionable.

However, as Fidelity Charitable proved in their study in early ’20, “How Donor Behaviors Are Shifting Amid Pandemic,” most donors actually plan to maintain or even increase their charitable investments.

How to reconcile these two points?

There is now a smaller pool of donors (or investors, as we prefer to call them) and more competition for dollars. This is undeniable. But the funds are out there … for nonprofits who can show the outcomes of their work in a way that is meaningful to their investors.

Positioning an organization for successful fundraising

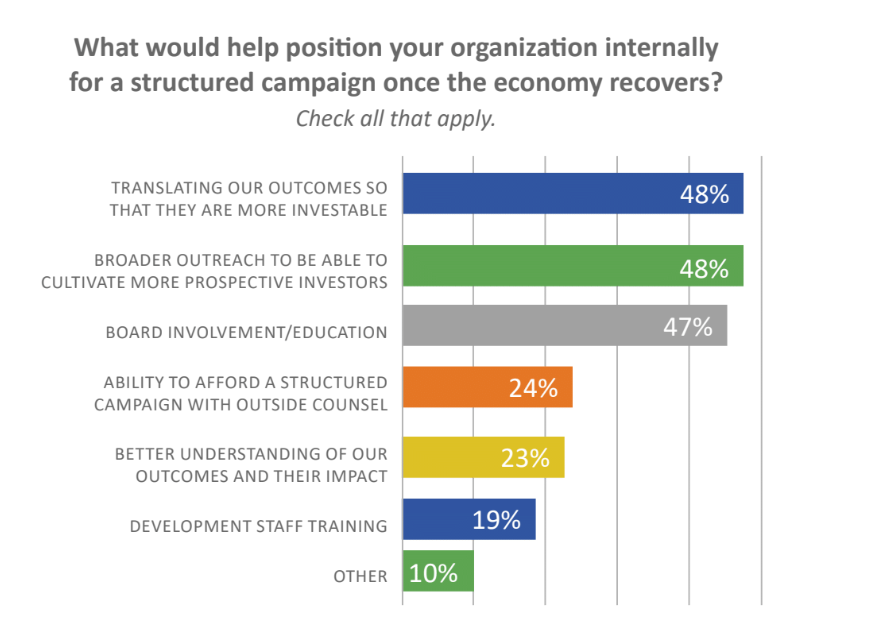

Our survey posed the question: What could you do internally that would help position your structured campaign for success once the economy recovers? Translating outcomes was either the top response or tied for the top response in seven of the nine nonprofit sectors across the entire survey. In the top three sectors, translating outcomes accounted for almost half of all responses.

This is consistent with what we have noticed over our past decade in fundraising. Emotionally-based fundraising has given way to a more rational approach, where providing some version of ROI and illustrating the value of specific outcomes are as important (if not more important) to achieving funding goals than providing specifics about a nonprofit’s mission and strategic plan. While outputs are a measure of activity, such as number of people served or hours volunteered, outcomes show the downstream impacts your organization has on your clients, your communities, and potentially the world. Outcomes show to what end outputs lead, and they can be more difficult to quantify.

For example, in a successful hospice fundraising campaign we ran, a few of the outcomes included specific dollars related to lessening the financial burden of the bereaved and the economic development catalyst to the city from the construction and ongoing operations of the new patient facility.

As stated in the book Asking Rights: Why Some Nonprofits Get Funded (and some don’t), if the program is what a nonprofit does and the output is the product of what it does, the outcome is what happens because of that product.

An outcome shows the true value the nonprofit provides to its constituents and its community. Thus, the importance of providing outcomes as part of a successful fundraising effort is easy to grasp. However, some nonprofits will fail before they start because they are not providing outcomes that are investable.

What makes an outcome investable?

Once outcomes are defined by a nonprofit, they will likely need to be refined and put in the language of investors. Investable Outcomes represent what new investments in an organization—even in times such as these—will make possible. They provide ROI and encompass the effectiveness of the organization’s implementation, focus, and strategy.

Specifically, they are outcomes that:

- Have a reasonable chance of succeeding

- Have acceptable “return”

- Can be translated into a value

- Allow investors to connect the dots

Often enhancing value through outcomes is best done by showing how positive outcomes are enhanced by a nonprofit (see the example above), how negative outcomes are minimized, social costs avoided, and downstream impacts realized. An example of negative outcomes minimized and social costs avoided might be a domestic violence shelter showing dollars saved from children kept out of the foster care system.

Times are different, yes. But fundraising can still succeed. To put a nonprofit on the path to a sustainable future, my first piece of advice is to take a look at the organization’s outcomes. To truly emerge ready for fundraising success, investable outcomes should be defined and proven to give investors and potential investors a clear view of the value of the organization now and down the road. To read more about this topic and more uncovered in our survey, feel free to download our white paper.